The RLN, which places tokenized assets and liabilities on the same ledger, was tested with simulated cross-border CBDC transactions in a previous project.

The Regulated Liability Network (RLN) has completed its United Kingdom discovery phase and is prepared to proceed to a use case with a retail central bank digital currency (CBDC), according to its latest report. The RLN project seeks to accommodate central bank, commercial bank and regulated non-bank transactions operating within “partitions” on a single network.

The RLN is a regulated financial marketplace infrastructure in the U.K. with contributors from financial institutions worldwide. It is supported by the advocacy group UK Finance.

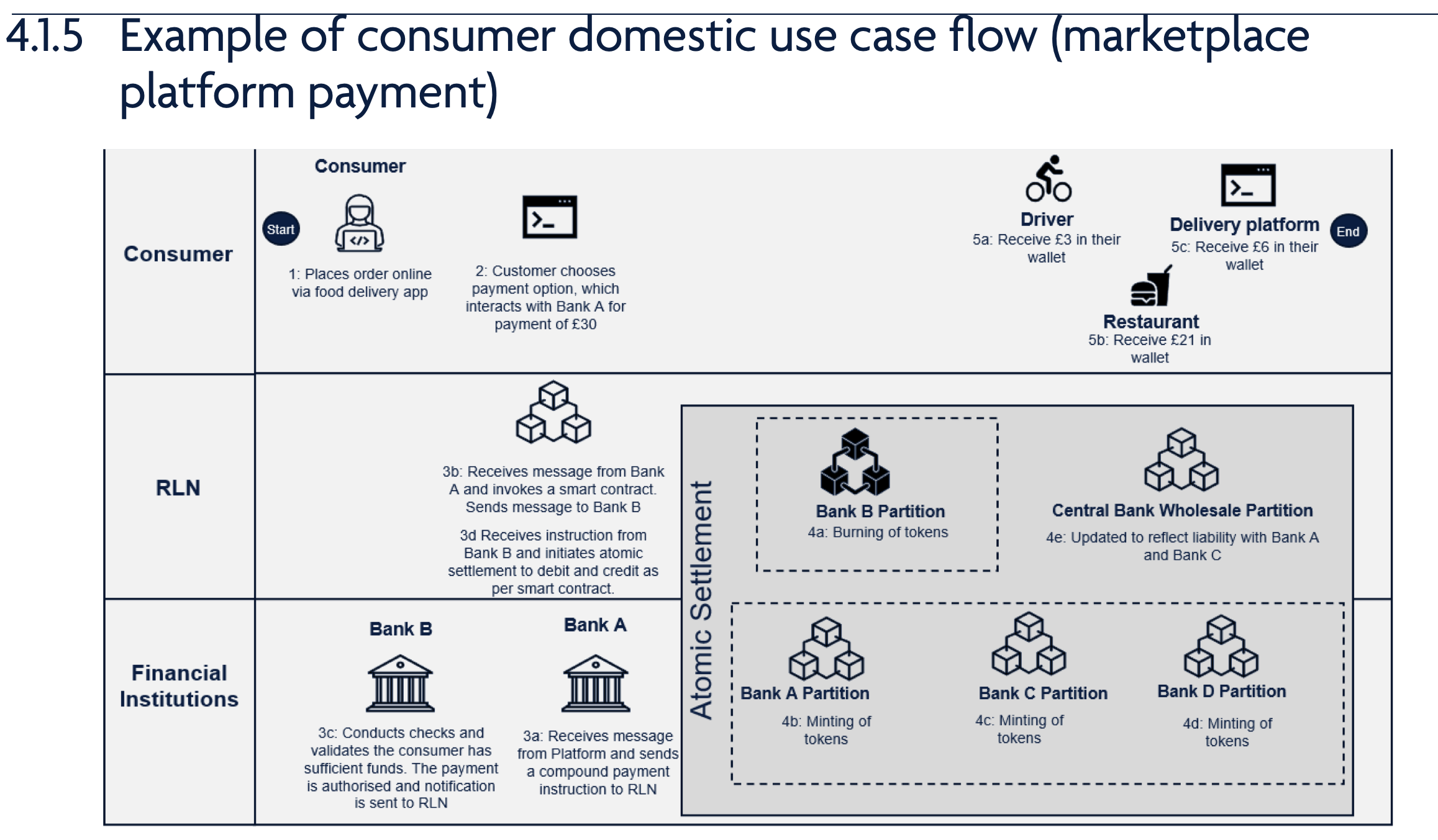

The RLN discovery phase examined three potential use cases for the network — consumer domestic payment, wholesale cross-border payment and securities settlement — and settled on the first case to pursue a proof-of-concept (PoC). The report noted many domestic payment uses that could be tested and cited the list presented in the results of Project Rosalind as examples. The report said:

“This use case would help explore how ‘upgraded’ commercial bank money could sit alongside a retail CBDC, how RLN could accommodate both forms of money on a single infrastructure, and how the functional equivalence of all retail digital money could be ensured.”

The report found that the RLN provided several benefits for domestic payments. It helped provide consistency between CBDCs and commercial bank money, thus helping preserve the singularity of the currency. It could also help reduce authorized push payment fraud — that is, payments authorized to fraudulent merchants — and give consumers more control in case of undelivered goods. Finally, it would improve settlement time.

The RLN would use a native settlement token and thus contain tokenized regulated money and digital assets on the same ledger. Tokenized liabilities (money) would remain claims on the issuer rather than on the RLN.

Related: SWIFT says it has reached a ‘breakthrough’ in recent CBDC experiments

The project completed a pilot program for wholesale cross-border payments in conjunction with the New York Federal Reserve Bank and several large financial institutions earlier this year. Now, however, the RLN says this particular use case “may be the least feasible for a PoC […] due to the complexity of dealing with multiple jurisdictions, participants (including central banks) and regulatory requirements.”

Securities settlement was judged to have a medium degree of feasibility due to the multiple nonbank parties involved and regulatory complexity.

The UK Regulated Liability Network, a blockchain network for interbank payments and other digital assets, plans to experiment with a retail digital pound backed by commercial bank money or tokenized deposits https://t.co/HiGqfQz67I

…#UK #DigitalPound #Tokenization #Fintech pic.twitter.com/BUyoMtyfA6— Digital Pound Foundation (@digitalpoundfdn) September 5, 2023

The RLN does not crucially depend on blockchain technology. The report identified five infrastructure architectures that it could operate on. The RLN closely resembles the “unified ledger” solution proposed by the Bank of International Settlements and the International Monetary Fund’s “trusted single ledger,” also introduced in June. The report’s authors also noted the project’s resemblance to a pilot conducted by the Swiss National Bank and the SIX digital exchange, as well as Bank of England Gov. Andrew Bailey’s proposed “enhanced digital money.”

Magazine: Home loans using crypto as collateral: Do the risks outweigh the reward?