Ethereum’s price rally toward $2,100 is driven by new developments in the layer-2 space and investors’ anticipation of a spot BTC ETF.

Ether (ETH) is trading higher on Dec.

However, the current positive momentum is supported by several factors, including applications for spot ETFs and the expansion of Ethereum’s ecosystem, driven by layer-2 solutions.

ETH benefits from ETF expectations and negative news related to competing blockchains

A pivotal development occurred on Nov. Securities and Exchange Commission (SEC) initiating the review process for Fidelity’s spot Ether ETF proposal, filed on Nov.

Despite analysts predicting the SEC might delay its decision to early 2024, interim deadlines for applications by VanEck and ARK 21Shares on Dec.

The Ethereum network’s growth, especially in transaction activity and layer-2 development, is noteworthy.

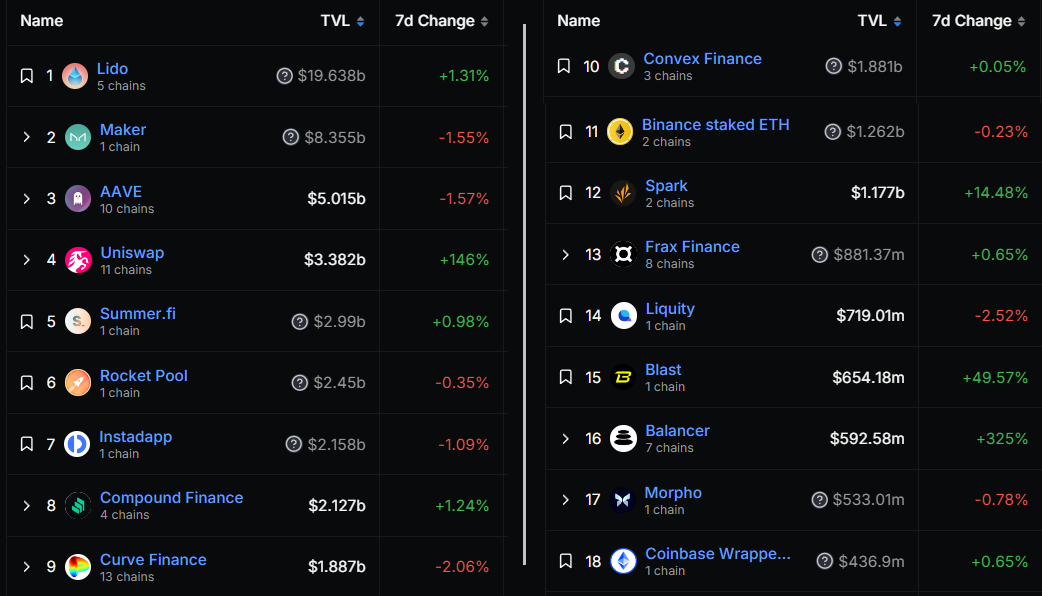

This growth is reflected in Ethereum’s total value locked (TVL), which recently hit a two-month high of 13 million ETH, spurred by a 13% weekly gain in Spark and a 60% increase in Blast user deposits.

In contrast, Tron, another leading blockchain in TVL terms, witnessed a 12% decline over the past ten days. Recent high-profile hacks linked to Tron’s founder Justin Sun have also swayed investor confidence toward Ethereum.

Read more