The Institute of International Finance looked at seven areas where digital euro legislation, which is being developed alongside the technology, is lacking.

The Institute of International Finance (IIF) has published an assessment of the European Commission’s proposed legislation on the digital euro. It gave the bill average marks.

The IIF is a financial industry global advocacy group headquartered in Washington, D.C. with members in 60 countries. It rated the digital euro bill introduced in June and the impact assessment that accompanied it. The note is a follow-up to its comments submitted in June.

The IIF looked at seven areas. It considered six of those areas “partly addressed” by the proposed legislation. Some of the cost-benefit analysis was “basic and high-level,” while other aspects were dependent on previous studies or missing.

The mechanism suggested for financial stability and bank intermediation in the bill is holding limits. Those limits have yet to be set, and it is unclear how they would be enforced, the IIF said.

Related: IBM offers guidance for successful implementation of digital euro

Payment services providers (PSPs) would have limited ability to recover the costs of implementing digital euro services, such as connecting to the infrastructure and creating wallet software, while caps are placed on fees. Credit institutions would be required to provide basic digital euro services for free. Therefore, “economic and liability model challenges” were also found to be only partly addressed, the study found.

Privacy controls on the digital euro have yet to be defined, the study noted, and it is not clear what PSPs will need to do in order to meet the requirements or if doing so will even be possible for them at the time of the digital euro’s introduction. Anti-Money Laundering and cybersecurity measures also remain to be established.

The Institute of International Finance welcomes the opportunity to respond to the European Commission (EC) questionnaire on a potential euro-denominated central bank digital currency (CBDC). https://t.co/A1MF505OEH @IIF #eurozone #financialsystem #DigitalEuro

— Fabien Risterucci (@FRProspektiv) June 18, 2022

Governance and conflicts of interest were not addressed in the legislation, the IIF said. As the bank supervisor and “issuer, administrator and fee-setter for a digital euro,” the European Central Bank (ECB) could find itself in conflicting roles of regulator and operator. There is no independent oversight envisioned for it.

The IIF also repeated its position on interoperability. It said:

“There is little-to-no value in settling for recreating parallel systems that could tie up capital and liquidity, face similar pain points, and be expensive. […] A CBDC would need to operate on platforms where other digital currencies otherwise operate.”

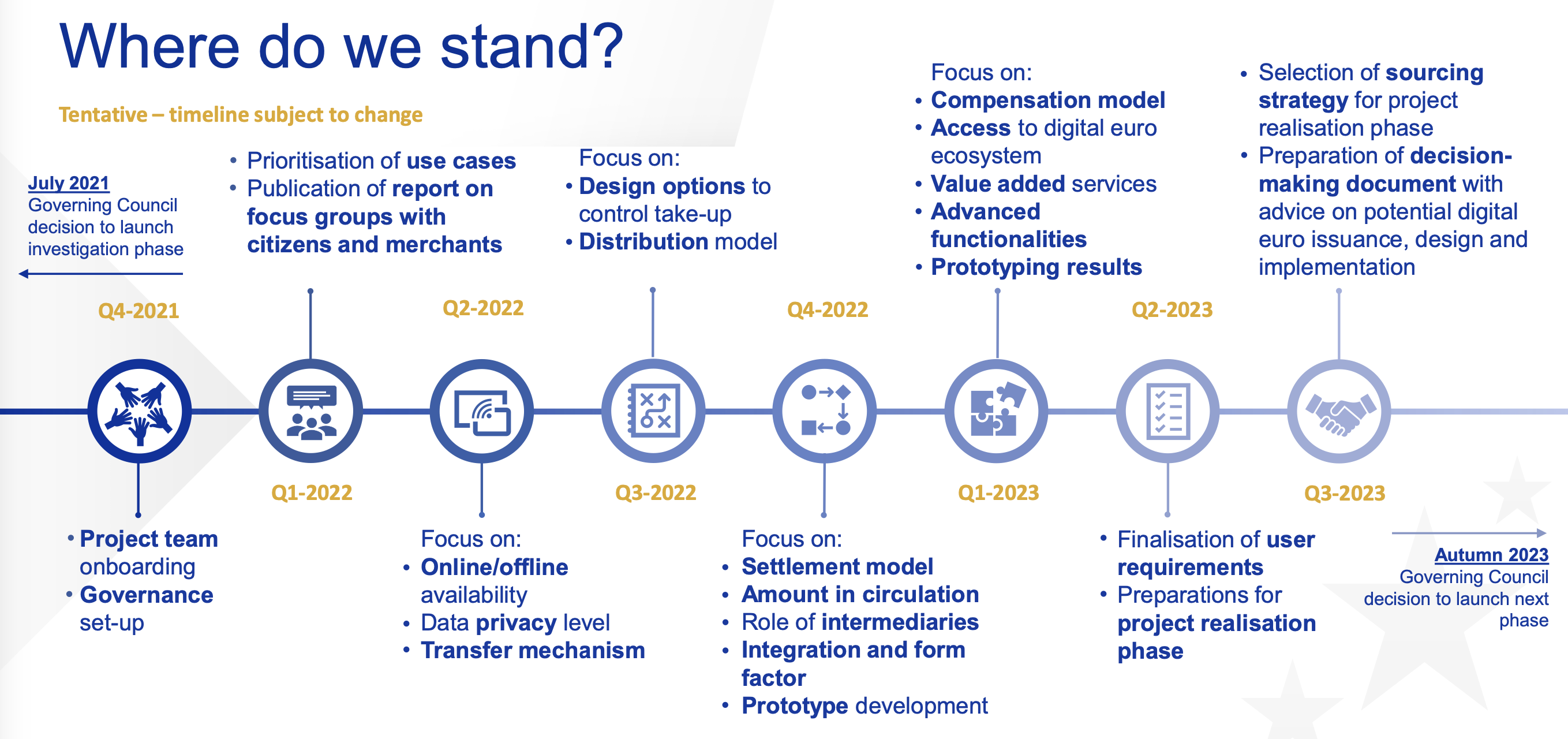

The legislative proposal for the digital euro is being developed in tandem with its infrastructure. The digital euro is expected to be in the investigative phase through October. After that, the ECB may decide to begin testing technical and business solutions, but either way, a live digital euro can only be issued after the legislation passes.

Magazine: Crypto City Guide to Prague: Bitcoin in the heart of Europe