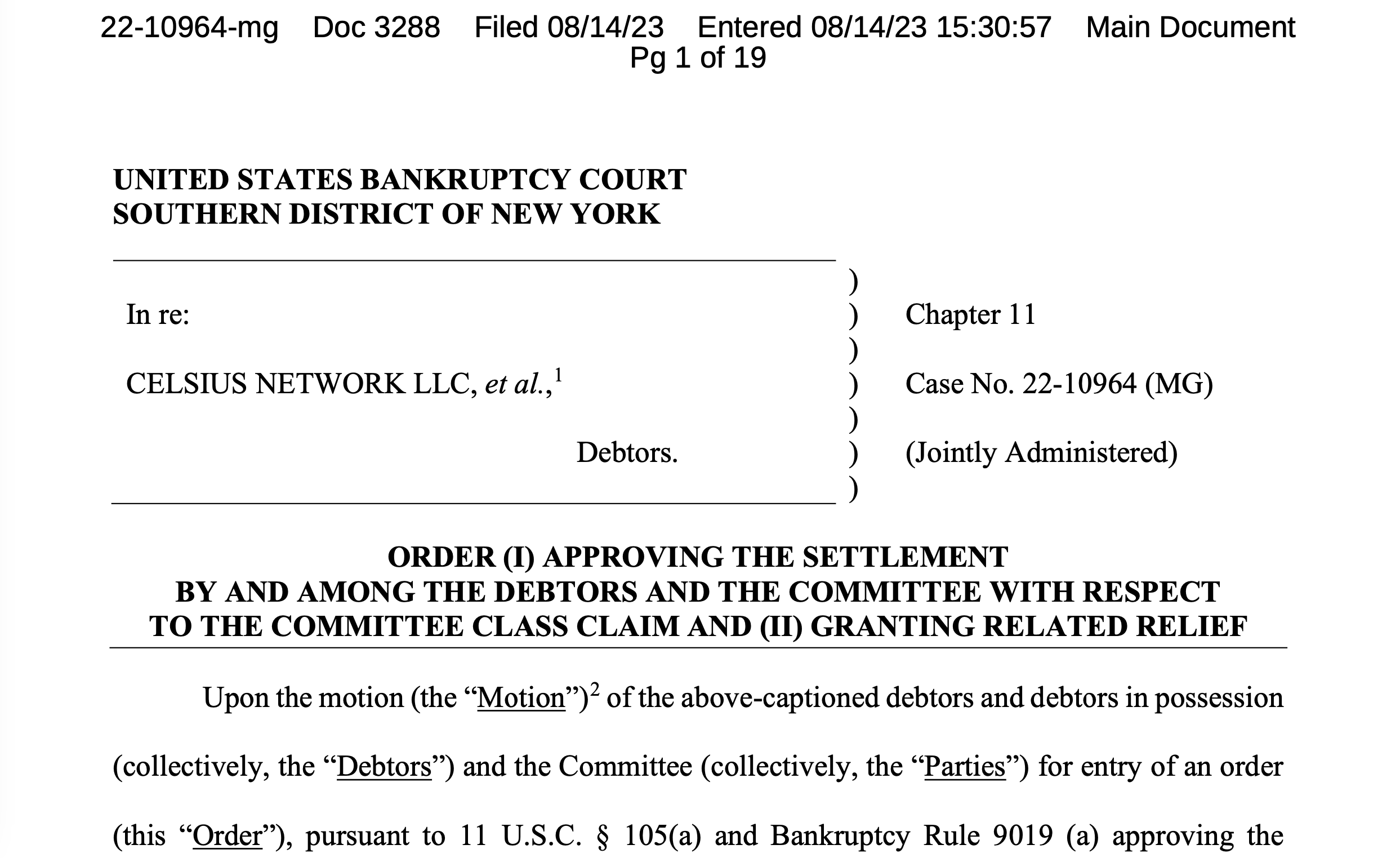

The settlement was reached in July and, if the customers agree, it will go before the court for approval in October.

Bankrupt crypto lender Celsius can start sending out ballots to its customers for a vote on a proposed settlement plan that would see a consortium called Fahrenheit buy Celsius’ assets and launch a new company. That company would distribute Celsius assets and equity in the new company to its customers.

Judge Martin Glenn of the Southern District of New York Bankruptcy Court approved a motion to allow Celsius customers to vote on a settlement of class claims to reimburse participants in Celsius’ Earn program, as well as to increase customers’ recoveries by 5% to resolve claims concerning fraud and misrepresentation by Celsius management.

According to Bloomberg, the asset distribution would be worth about $2 billion. It added that Glenn additionally instructed Celsius to provide a “plain language” explanation of the settlement and material on crypto volatility and challenges Celsius’ mining operations could face.

Related: Celsius seeks to convert alts to Bitcoin and Ether under reorganization plan

Customers have to opt out of the settlement in order not to participate. Celsius lawyer Chris Koenig was quoted by Bloomberg as saying disbursements could begin before the end of the year.

If approved, the plan will still require court approval, which could come in October.

Fahrenheit won an auction for Celsius assets on May 25. Part of the offer was a promise for US Bitcoin Corp., one of the consortium members, to construct a new 100-megawatt crypto mining plant.

#CELSIUS HEARING LIVE: #SEC making their appearance for the record. K&E giving an update on disclosure statement objections. UST & debtors will move objections to confirmation statements. Earn Ad Hoc amended reservation of rights. K&E say $CEL should not be a disclosure issue.

— Simon Dixon (@SimonDixonTwitt) August 14, 2023

Celsius halted withdrawals on June 13, 2022, in the wake of the collapse of the Terra ecosystem, and filed for bankruptcy in July of that year. Since then, former CEO Alex Mashinsky has been arrested for fraud. Last month, the United States Securities and Exchange Commission filed suit against Mashinsky and other Celsius executives, and the U.S. Federal Trade Commission issued $4.7 billion in fines against the company last month.

Magazine: Simon Dixon on bankruptcies, Celsius and Elon Musk: Crypto Twitter Hall of Flame