The proposal suggests that a cap should be imposed on the use of CRV as collateral, preventing this wallet address from adding more loans.

A June 12 AAVE (AAVE) proposal aimed at preventing a particular account from accumulating more debt has led to controversy, with some participants arguing that the proposal violates the principle of censorship-resistance or “neutrality” in decentralized finance, or DeFi.

Some participants believe that the account is owned by Curve (CRV) founder Michael Egorov. Cointelegraph was not able to independently confirm who the account’s owner is.

Uhh seems like Curve’s founder has a $110m leverage position against his $CRV stack across all Defi.

If not repaid at some point (spoil: it prob won’t, my man is taking profit), this will cascade into a lot of bad debt for lending protocols https://t.co/kxwc0Sk65V pic.twitter.com/yhHp9JFWBV

— vapor (@trading_vapor) June 14, 2023

According to the proposal’s author, financial modeling platform Gauntlet, the Ethereum address 0x7a16ff8270133f063aab6c9977183d9e72835428 has accumulated $67.7 million worth of debt in USD Coin (USDC) and Tether (USDT) through the AAVE v2 protocol using $185 million of Curve tokens as collateral.

Gauntlet expressed fears that this account may continue increasing its debt, leading to the risk that it may be liquidated if there is a sudden fall in the price of Curve. Compounding the problem in Gauntlet’s view is the fact that CRV has suffered a decline in liquidity over the past few months. This may cause slippage if the account gets liquidated, as there may not be enough buyers of CRV in the marketplace willing to take on such a large amount of tokens.

This may lead to millions of dollars in bad debt for AAVE, Gauntlet suggested.

AAVE user DecentMuse claimed that the wallet address “is tagged as belonging to the founder of Curve,” indicating that it may belong to Egorov. In DecentMuse’s view, the loan may represent a way for the founder to take profits from his entrepreneurial activities on behalf of Curve. Cointelegraph was not able to confirm the identity of the address’s owner.

In the proposal, Gauntlet suggested that the AAVE decentralized autonomous organization (AAVE DAO) should implement a patch to freeze any further uses of CRV as collateral for loans. This would allow the account to continue holding its current loan position but would also prevent it from accumulating any further debt.

Related: Bug in Aave v2 on Polygon causes some assets to become stuck in contracts

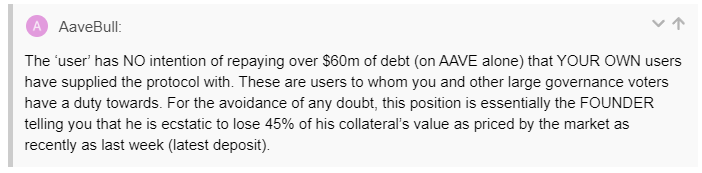

Some forum participants supported the proposal and criticized the account for piling on so much debt. For example, a user who goes by the handle “AAVEBull” reportedly claimed that the account must have no intention of paying off its debts since it has continuously added to its position as the token has declined in price.

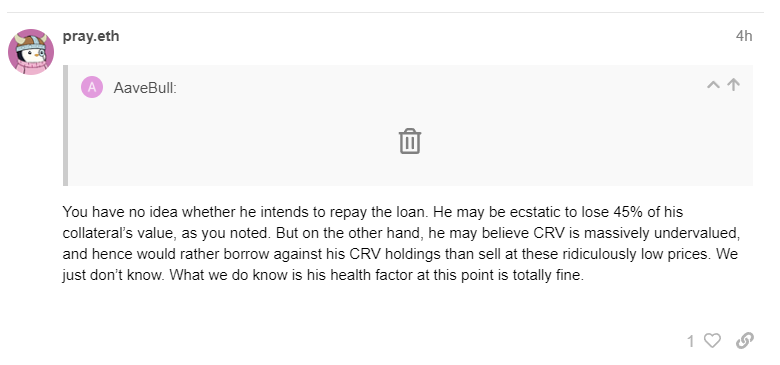

In response, critics of the proposal defended the account. For example, user pray.eth stated that the account’s owner might simply believe CRV tokens are radically undervalued, leading them to believe that as the price declines, it makes sense to increase their use as collateral.

Aave-Chan Initiative founder Marc Zeller, who is a frequent participant in the forums, also weighed in on the proposal. He stated that AAVE DAO should be careful not to violate “the core ethos of DeFi, which is neutrality.” “The intention of users or what they do with their funds is not our primary concern,” Zeller stated, adding, “Users should be free to utilize the protocol as they see fit.”

The proposal is listed as a “recommendation” as of June 16. This means that it has not yet been turned into a formal AAVE Improvement Proposal (AIP) that can be voted on by the DAO. The author has stated that turning it into a formal AIP is the proposal’s “next step.”

Participants in the blockchain ecosystem continue to debate the limits of censorship resistance. In January, many Bitcoin users complained of high fees caused by other users minting and trading Ordinals. Some users wanted to ban Ordinals, while others saw a ban as censorship.

On April 11, Tether blacklisted an address that had drained $25 million from EVM front-running bots. Polygon co-founder Jaynti Kanani said the blacklisting established “a bad precedent” that could lead to more transactions being censored, while on-chain sleuth ZachXBT claimed that Tether may have been forced to engage in the act due to a court order.

Magazine: Hyperbitcoinization is underway, RFK seeks Bitcoin donations and other news