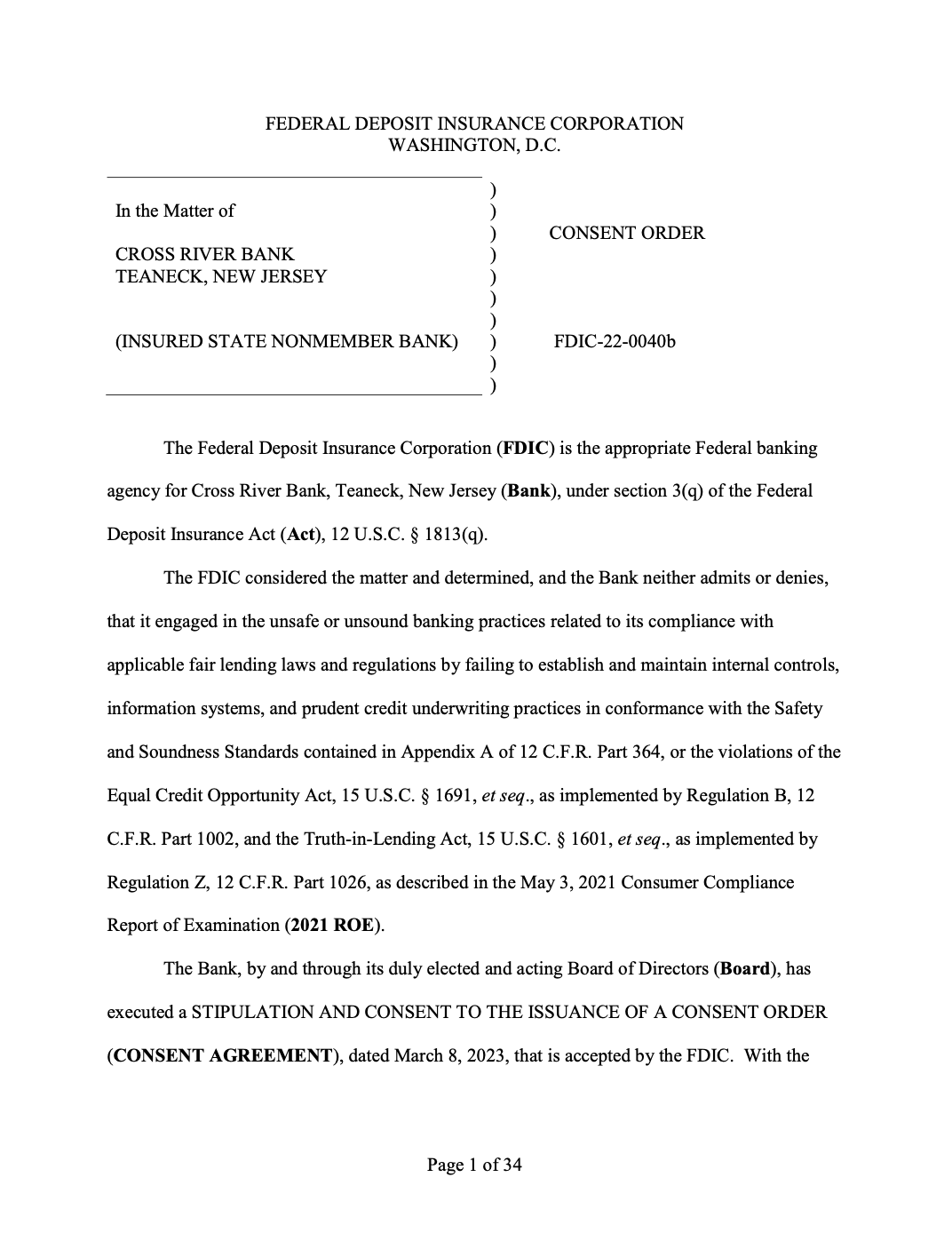

Cross River is yet to admit nor deny the allegations that it “engaged in the unsafe or unsound banking practices” related to its lending activity in 2021.

The Federal Deposit Insurance Corporation (FDIC) has requested Cross River Bank – known for its services to fintech and crypto firms like Visa and Coinbase – to “self-correct” and appropriately address weaknesses in its lending activities.

On April 28, the FDIC made public a consent order executed with Cross River Bank on March 8, which alleged that the bank engaged in “unsafe” or “unsound” banking practices in regard to its compliance with applicable fair lending laws and regulations in 2021.

Despite accepting the consent order, Cross River has yet to admit nor deny the violations discovered in the 2021 report of examination. It was noted:

“The FDIC considered the matter and determined, and the Bank neither admits or denies, that it engaged in the unsafe or unsound banking practices related to its compliance with applicable fair lending laws and regulations”.

The order states that the bank must immediately take action to increase its supervision over the “system of internal controls, information systems, credit underwriting practises, and internal audit systems related to the consumer protection laws and regulations.”

Cross River is required to promptly “self-correct” any violations of fair lending laws.

Furthermore, it was ordered that the crypto-friendly bank “appropriately address” the deficiencies and weaknesses identified in its lending activites, as well as create processes to prevent their recurrence in the future.

The FDIC requested that Cross River fully comply with the consent order in a “timely manner.”

Just one day before the consent order was made public, Cross River’s CEO, Gilles Gade, released a statement on April 27, without any mention to the FDIC allegations.

Gades emphasized that Cross River upholds the “highest levels of compliance” as he highlighted that regulatory scrutiny is only going to get tougher for banks that support fintech, following the collapse of Silicion Valley Bank.

“Cross River is the largest of these banking institutions and as such, we have regulatory examiners reviewing some elements of our business on a continuous basis” Gades stated.

“We view our compliance capability as a strategic advantage and are proud to lead our industry in maintaining the highest levels of compliance, transparency, and responsibility” he added.

Related: Crypto-friendly banks mismanaged traditional risks, FDIC head tells Senate hearing

The order was executed with the bank only days before Circle, the stablecoin issuer behind USD Coin (USDC), partnered with Cross River for banking services on March 13.

Circle had sought the new partnership, after the collapse of it’s previous provider, Silicon Valley Bank.

Magazine: Unstablecoins: Depegging, bank runs and other risks loom