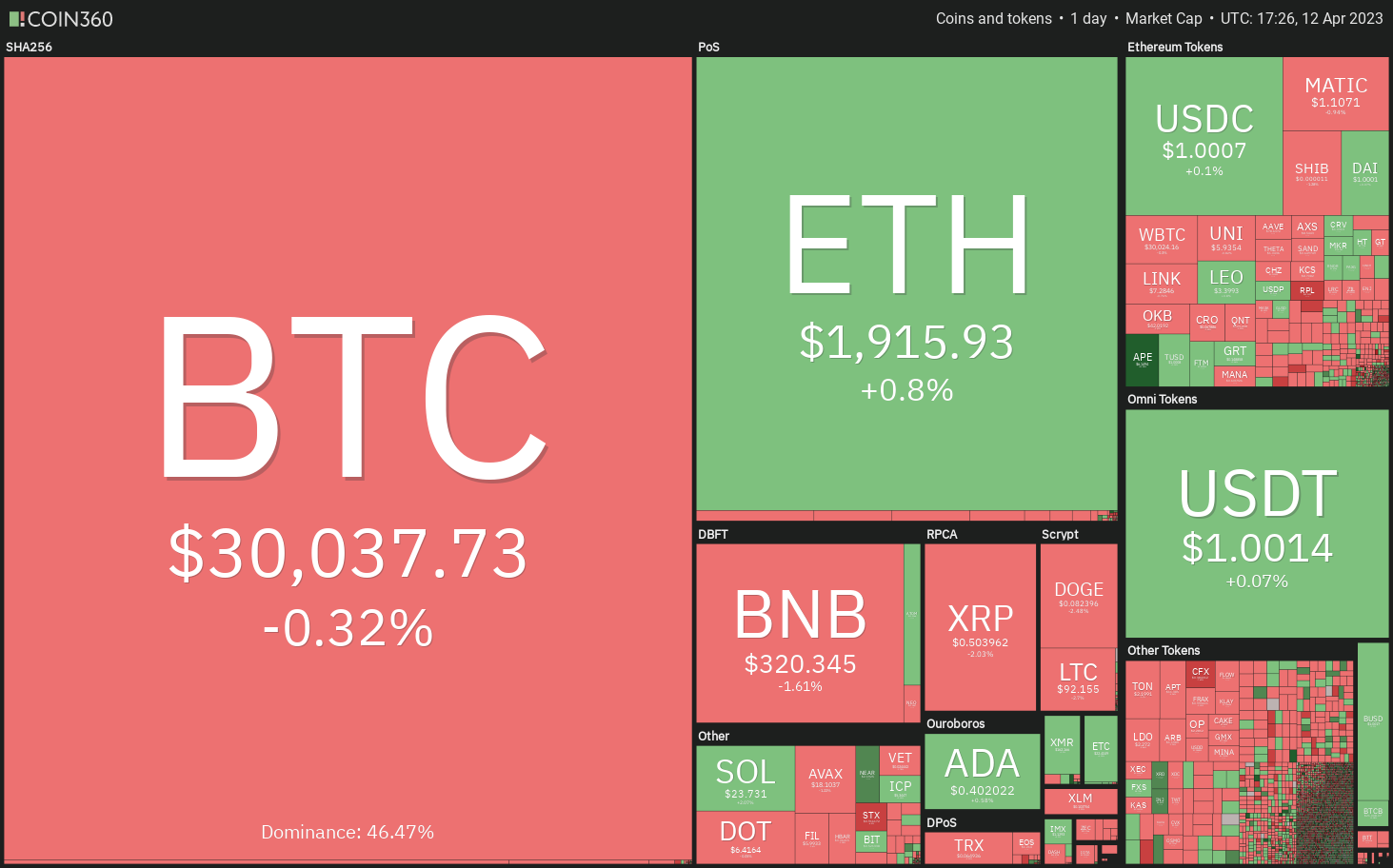

Today’s CPI report highlighted a slight decline in inflation, a development which could put a strong price floor beneath Bitcoin and select altcoins.

The March consumer price index climbed marginally by 0.1%, below economists’ expectation of a 0.2% increase and February’s advance of 0.4%. Although inflation is showing signs of slowing, the year-on-year CPI increased by 5%, well above the U.S. Federal Reserve’s 2% target.

The FedWatch Tool shows a 67% probability of a 25 basis point rate hike in the Fed’s May meeting, but by the end of the year, the majority of the market participants have come to expect rates to be lower than the current level.

An expansive monetary policy is usually positive for risky assets. In addition, crypto traders will focus on Bitcoin’s (BTC) halving, which is set to occur next year. That is also likely to be a positive for cryptocurrency prices. While the near-term picture is uncertain, the long term remains bullish.

Will traders book profits in the near term, pulling Bitcoin and altcoins lower, or will the rally extend further?

Let’s study the charts of the top-10 cryptocurrencies to find out.

Bitcoin price analysis

Bitcoin is witnessing resistance near $30,550, but a positive sign is that the bulls have not given up much ground. This suggests that the buyers are not rushing to the exit.

The bears are unlikely to give up without a fight. They will try to yank the price below the 20-day exponential moving average ($28,163), which remains the key support level to keep an eye on. If they are successful, the selling could pick up and the BTC/USDT pair may slump to the support at $25,250.

Conversely, if the price continues to move up from the current level or rebounds off the 20-day EMA, it will signal strong demand at lower levels. That will enhance the prospects of a rally to $32,400, which is likely to behave as a formidable resistance.

Ether price analysis

Ether (ETH) snapped back from the 20-day EMA ($1,831) on April 9, but the bulls could not push the price above the immediate resistance at $1,943.

If the price turns down from the current level and breaks below $1,824, the ETH/USDT pair will form a double top in the short term. That may tug the price down to the strong support at $1,680.

If bears want to keep the uptrend intact, they will have to protect the 20-day EMA and force the pair above the resistance at $1,943. If they can pull it off, the pair may resume its up-move. The $2,000 level may offer a resistance but it is likely to be crossed. The pair may then rally to $2,200.

BNB price analysis

BNB (BNB) surged above the $318 resistance on April 11, but the long wick on the candlestick shows that the bears are selling near $338.

The 20-day EMA ($315) is flattish and the RSI is turning down toward the center. This indicates a potential range-bound action in the near term. If the price slips below the 20-day EMA, the BNB/USDT pair may oscillate between $338 and the 200-day SMA ($292) for a few days.

Another possibility is that the price rebounds off the 20-day EMA with strength. That will suggest buying on dips. The bulls will then again try to kick the pair above the overhead zone between $338 and $346.

XRP price analysis

The long wick on XRP’s (XRP) April 11 candlestick shows that the bears are trying to stall the recovery at $0.53.

Sellers will try to strengthen their position by pulling the price below the 20-day EMA ($0.49). If they are successful, several short-term bulls may be forced to close their positions. The XRP/USDT pair may then slump toward the next support at $0.43.

Instead, if the price rebounds off the 20-day EMA, it will suggest that bulls continue to view the dips as a buying opportunity. The bulls will have to overcome the stiff resistance at $0.53 to regain the upper hand.

Cardano price analysis

Cardano (ADA) turned down from the neckline of the inverse head and shoulders (H&S) pattern, indicating that the bears are trying to halt the recovery at this level.

The 20-day EMA ($0.38) is an important level to watch out for on the downside. If the price bounces off this level, it will suggest that the sentiment remains positive and traders are buying on dips.

That will increase the likelihood of a break above the neckline. If that happens, the reversal pattern will complete. The ADA/USDT pair may then start a new uptrend toward $0.60.

Conversely, if the pair plummets below the 20-day EMA, it will suggest that the short-term traders are booking profits. That may sink the pair to the 200-day SMA ($0.35).

Dogecoin price analysis

Dogecoin’s (DOGE) rebound off the moving averages could not even reach the 38.2% Fibonacci retracement level of $0.09. This suggests that the bears are selling on every minor rise.

The DOGE/USDT pair has slipped back to the moving averages, which shows that bears are trying to strengthen their position. If they yank the price below the moving averages, the pair may fall to the crucial support at $0.07.

On the other hand, if the price once again rebounds off the moving averages, it will suggest that the bulls are aggressively protecting the level. Buyers will then make one more attempt to push the price toward the $0.11 level.

Polygon price analysis

The bears are trying to sink Polygon (MATIC) below the support line of the symmetrical triangle pattern.

If they succeed, it will suggest that the supply exceeds demand. The MATIC/USDT pair may then descend toward the 200-day SMA ($0.99), which is an important level to keep an eye on. If this level gives way, the pair may start a downtrend.

Contrarily, if the price turns up from the current level and breaks above the 20-day EMA ($1.11), it will suggest that the breakdown may have been a bear trap. The pair may then attempt to rise above the resistance line of the triangle.

Related: Why is Dogecoin (DOGE) price down today?

Solana price analysis

After hesitating for several days, Solana (SOL) finally soared above the downtrend line on April 11. This is the first indication that the downtrend may be ending.

Usually, after breaking out of a significant resistance, the price turns down and retests the level. In this case, the price may dip down to the breakout level. If the price rebounds off the downtrend line, it will suggest that the bulls have flipped the level into support. That will enhance the prospects of a potential rally to $27.12 and thereafter to $39.

This positive view will invalidate if the price turns down and breaks below the downtrend line. Such a move will suggest that the breakout may have been a bull trap. The SOL/USDT pair may then tumble to $15.28.

Polkadot price analysis

Polkadot (DOT) turned down from the downtrend line on April 12, indicating that the bears are fiercely guarding this level.

If the price dips and sustains below the 20-day EMA ($6.24), the DOT/USDT pair may slump to the strong support at $5.70.

On the contrary, if the price turns up from the 20-day EMA, it will suggest that traders are buying the minor dips. The bulls will then again try to thrust the price above the downtrend line. If they manage to do that, the pair is likely to pick up momentum and soar toward the neckline of the H&S pattern.

Litecoin price analysis

Buyers pushed Litecoin (LTC) above the overhead resistance of $96 on April 11 but they could not sustain the higher levels, as seen from the long wick on the day’s candlestick.

The bears have used the opportunity to pull the price back to the 20-day EMA ($90). This is an important level to watch for because a break and close below it could sink the LTC/USDT pair to the support at $85. A bounce off this level may keep the pair stuck inside the $96-to-$85 range for a few days.

If bulls want to retain their edge, they will have to drive the price above $96. That will open the doors for a possible up-move to $106. On the other hand, a break below $85 could tug the pair to $75.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.