Golden crosses and death crosses are key signals that technical analysts use to determine whether an asset is trending upward or downward.

How can traders use the golden and death crosses in their trading strategies?

Traders typically buy during a golden cross and sell during a death cross.

Different traders will have different approaches to crossover signals. Some traders might wait for a confirmed golden or death cross before entering or exiting a trade. Others might use the crosses as confirmation signals in conjunction with other technical indicators.

In general, however, the golden and death crosses can be used as trend-reversal signals. If a trader sees a golden cross forming, they might buy an asset in anticipation of prices rising. Similarly, if a trader sees a death cross forming, they might sell an asset in anticipation of prices falling.

Of course, it is always important to use caution when trading crossover signals, as blindly following them might lead to losses. As mentioned, false signals occur and it’s important to confirm any crossover signal with other technical indicators before taking a position.

Seasoned traders also know to look at the bigger picture and consider multiple readings. For instance, a golden cross might happen on an hourly time frame, but zooming out to look at the daily or weekly time frame might show that a death cross is actually in play.

Trading volume is also something to look out for when trading crossover signals, as volume spikes may very well confirm or deny the validity of a signal.

Purchase a licence for this article. Powered by SharpShark.

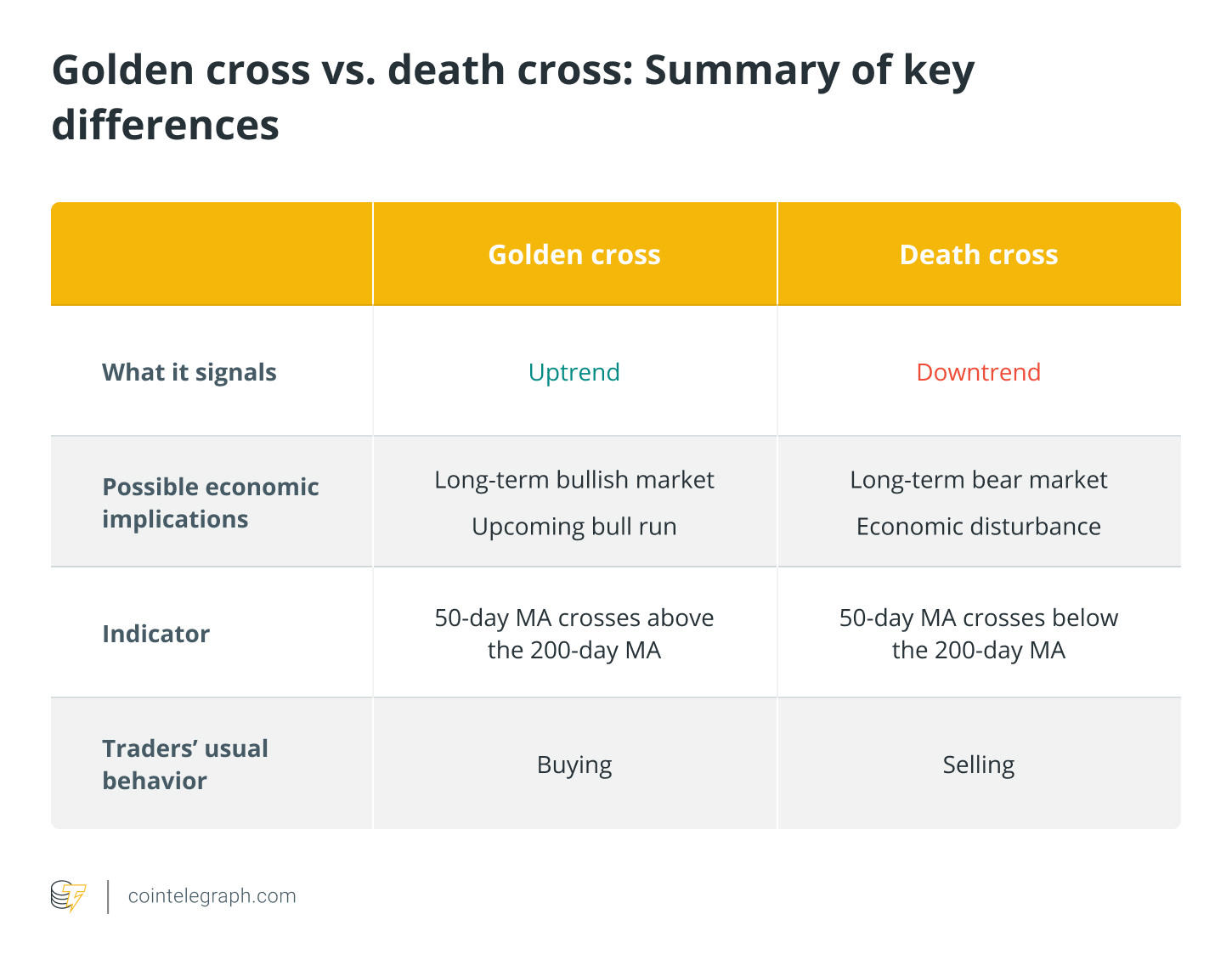

What’s the difference between a golden cross and a death cross?

The key difference between a golden cross and a death cross is that the former signals an uptrend while the latter indicates a downtrend.

As mentioned, the two are essentially opposites, in terms of how they appear on the chart and what they signal. Since MAs are lagging indicators, both crosses only serve to confirm the occurrence of a trend reversal, not predict it. As such, they should be used in conjunction with other technical indicators to better understand market conditions.

The golden cross and the death cross are usually confirmed by high trading volume. Other technical indicators that analysts may look at are the moving average convergence divergence and the relative strength index.

Death crosses typically signal the beginning of a long-term bear market, not just in crypto but overall stock markets. The death cross heralded the arrival of major economic crises in the past, such as the Black Monday stock market crash of 1929 and the 2008 financial crisis.

That said, death crosses may also indicate false signals and are not 100% accurate. For instance, there have been instances of markets recovering after a death cross.

On the other hand, golden crosses signal the arrival of a long-term bullish market. But, despite its apparent predictive ability in forecasting previous huge bull runs, golden crosses may also produce false signals.

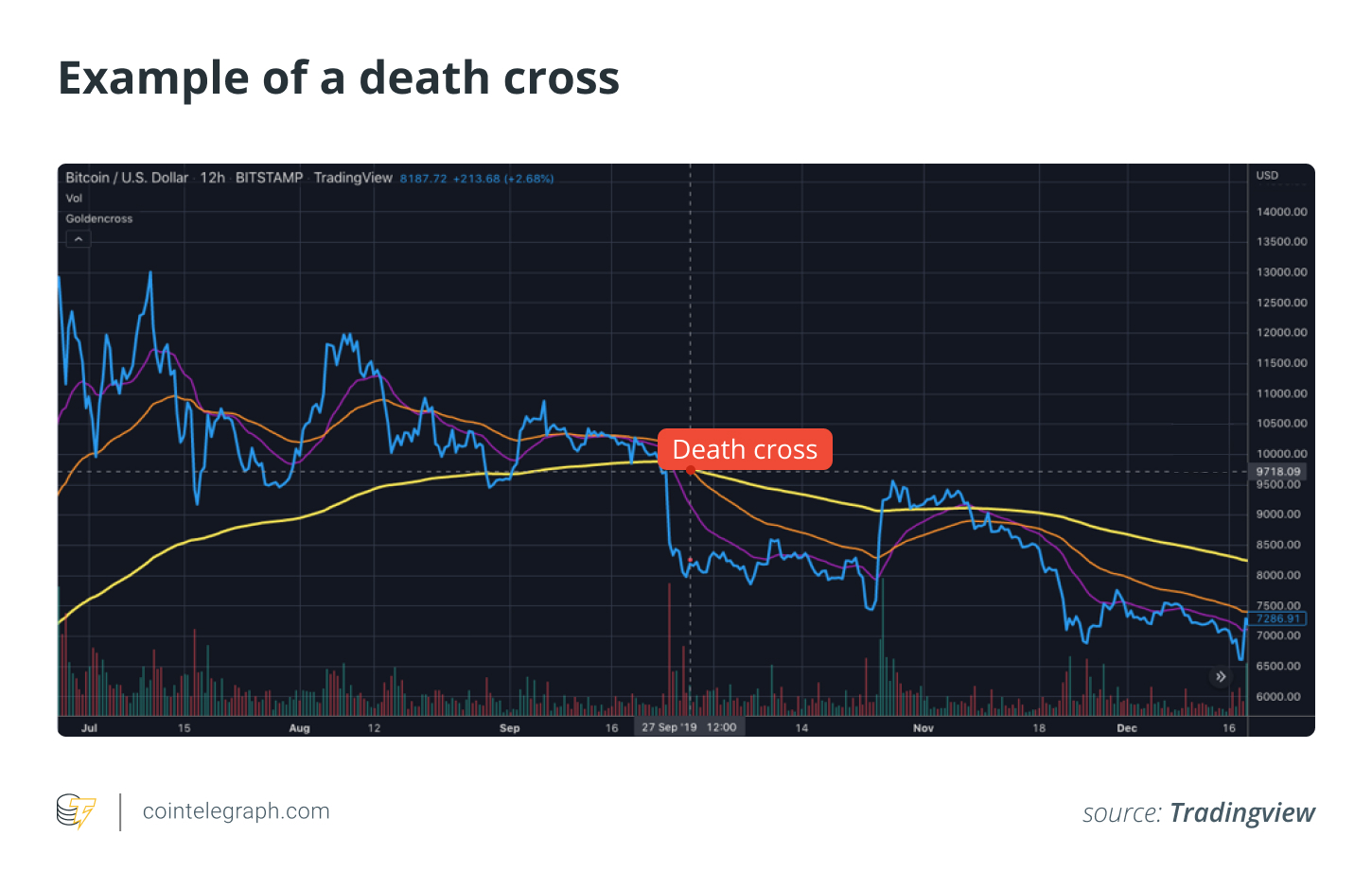

What is a death cross?

Compared to the golden cross, a death cross involves a downside MA crossover. This marks a definitive market downturn and typically occurs when the short-term MA trends down, crossing the long-term MA.

Simply put, it’s the exact opposite of the golden cross. A death cross is usually read as a bearish signal. The 50-day MA typically crosses below the 200-day MA, signaling a downtrend.

Three phases mark a death cross. The first occurs during an uptrend when the short-term MA is still above the long-term MA. The second phase is characterized by a reversal, during which the short-term MA crosses below the long-term MA. This is followed by the start of a downtrend as the short-term MA continues to move downward, staying below the long-term MA.

Like golden crosses, no two death crosses are alike, but specific indicators signal their occurrence. Here’s a look at each stage of a death cross in detail. The first stage of a death cross is typically marked by an asset being in an uptrend. This is followed by a weakening 50-day MA, the first sign that bearishness may be on the horizon. As prices begin to fall after they peak, the short-term MA diverges from the long-term MA.

The second stage sees the 50-day MA crossing below the 200-day MA. This is a key point, as it signals that the asset may be entering a downtrend. The divergence between the two MAs becomes more pronounced as prices continue to fall. The death cross begins to form much more clearly during this stage.

The final stage is marked by the 50-day MA continuing to trend downward, staying below the 200-day MA. This signals that a downtrend is indeed underway. The death cross typically leads to further selling pressure as traders liquidate their positions in anticipation of further price declines.

If, however, the downtrend is not sustained, it could mean a short-lived momentum and prices rebounding quickly, in which case, the death cross is considered to be a false signal.

What is a golden cross?

A so-called “golden cross” occurs when a short-term MA and a major, long-term MA cross over toward the upside. A golden cross suggests a price rise and an upward turn in the market.

The short-term MA moves upward much faster than the long-term MA until market conditions push them to cross. In terms of simple moving averages, golden crosses occur when the 50-day SMA crosses above the 200-day SMA, indicating a definitive uptrend.

A golden cross formation typically has three stages. When selling is depleted, it usually marks the end of a downtrend and thus, the beginning of a golden cross. The next stage is when the short-term MA crosses through the long-term MA. This is quickly followed by the last stage, marked by a continuing uptrend, usually leading to higher prices.

No two golden crosses are identical, but these three stages are usually the distinctive events that mark the occurrence of a golden cross. Let’s look at each stage in more detail.

During the first stage, buyers are taking control of a downtrend. A short-term weakness in the 50-day moving average signals the beginning of a golden cross. This is because the resulting strength typically arises from buyers beginning to take control just as short-term sellers are drying up.

A leveling out occurs on the chart, with buyers driving prices higher as they try to gain control. The resulting momentum gradually pushes the 50-day MA through the 200-MA, at which point the two periods cross. When the 50-day MA surpasses the 200-day MA, traders typically go on high alert to determine whether an uptrend is occurring or if it’s just a false alarm.

The final stage happens as the 50-day MA continues to push up, indicating its momentum. This also typically leads to overbuying, albeit only in short bursts.

What is a moving average?

The moving average is a stock indicator commonly used in technical analysis that helps create a constantly updated average price.

A clear grasp of moving average (MA) is crucial in better understanding the golden cross and the death cross. Generally, MAs are calculated to determine the trend direction of an asset or to identify its support and resistance levels.

The MA is a technical indicator that refers to the average price of a specific asset over a defined period. MAs indicate whether the asset is trending in a bullish (positive, upward) direction or moving in a bearish (negative, downward) direction.

MAs provide useful signals when trading cryptocurrency charts in real time. They can also be adjusted to different periods, such as 10, 20, 50, 100 or 200-day periods. Such periods highlight market trends, making them easily identifiable.

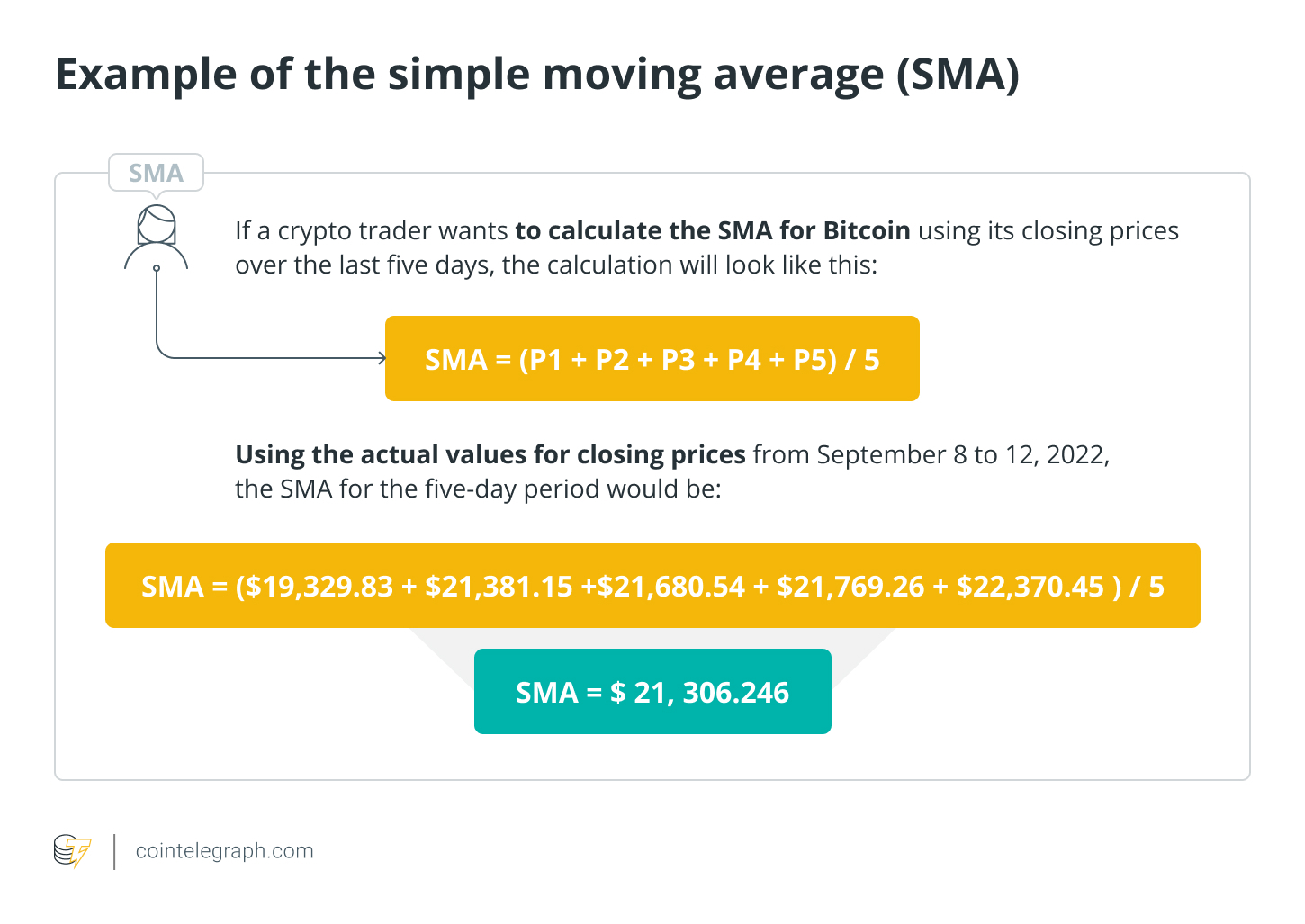

Traders also use different types of MAs. The first is the simple moving average (SMA), which takes an asset’s average price over a certain period divided by the total number of periods.

Another is the weighted moving average, which, as the name indicates, assigns more weight to recent prices. This makes the value more reflective of recent changes in the market. An exponential moving average, on the other hand, while attributing more weight to recent prices, does not remain consistent with the rate of decrease between a specific price and the price before it.

Moving averages, also called “lagging indicators,” are based on historical prices. Traders use MAs as signals to guide them in buying and selling assets, with the 50-day and 200-day periods being the most closely watched among crypto traders.