BTC

Bitcoin was back testing the $20,000 level over the weekend as Federal Reserve policy expectations weighed on risk assets.

The world’s largest cryptocurrency by market cap suffered after comments from Federal Reserve Chair Jerome Powell.

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth.

“Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

The comments added to pressure on stock markets as the central banker telegraphed a longer period of higher rates. BTC slumped in thin weekend trading, worsened by fears over the release of coins from the Mt. Gox funds exchange trial.

Claims were varied, with some believing that a sum of up to 137,000 BTC was set for release in one move. Others said that funds would be sent in parts but agreed that it would start this week.

Mt. Gox collapsed with hundreds of thousands of bitcoins almost ten years ago. Following a lengthy legal battle, the appointed rehabilitation trustee, Nobuaki Kobayashi, announced on July 6 that he was “preparing to make repayments” to creditors.

“Following discussions with the Court and in accordance with the Rehabilitation Plan, the Rehabilitation Trustee plans to set the Assignment, etc. Restriction Reference Period from approximately the end of August this year until all or part of the repayments made as initial repayments is completed for safe and secure Repayments,” part of it read.

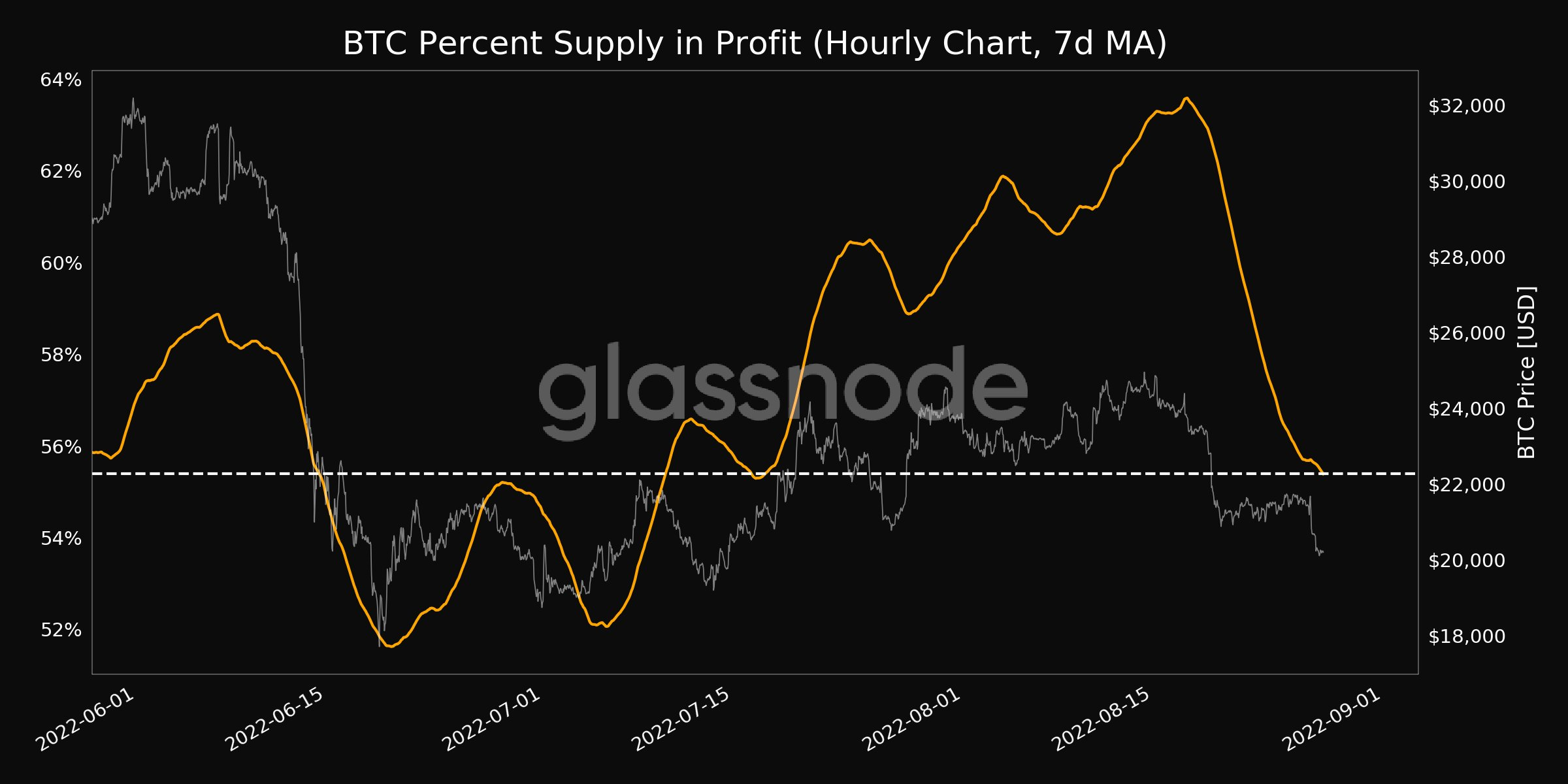

In other data from on-chain analytics firm Glassnode, the percentage of the overall BTC supply in profit hit a one-month low just above the 55% level.

BTC was trading below the $20,000 level and the recent activity has some analysts worried about a September Black Swan event.

ETH

The Ethereum blockchain is moving closer to its planned Sept. 15 Merge as it transitions from its current proof-of-work mining consensus to proof-of-stake (PoS).

Despite the improvements to the chain, bullish enthusiasm in terms of token price and market sentiment seems to be on declining as the Merge nears. There has been a sharp decline in the holdings of many ETH whales.

Data from crypto analytics firm Santiment has shown that the gap between Ethereum’s top 10 largest non-exchange and exchange addresses is closing. Over the past three months, big whale addresses have sent a significant amount of ETH onto exchanges. Non-exchange addresses have declined 11%, while exchange-based addresses have surged by 78%.

The flow of crypto back onto exchanges generally reflects bearish sentiment and is done by traders wishing to cash out by selling their tokens. It is also a sign that whale investors predict lower prices in the near future.

Many market analysts also believe the Merge will be a “buy the rumor, sell the news” event. They expect the ETH price to rally into the Merge event but sell off once it has completed the upgrade.

The Merge will mark the completion of the second of three phases in Ethereum’s transition to PoS. The process began in December 2020 with the launch of the Beacon Chain.

The current phase was scheduled for completion in mid-2021; however, the project was beset by delays. Those delays hurt the price of Ethereum and led to it losing more of its value on a percentage basis than Bitcoin in the recent bear market move lower.

The move to PoS solves some key issues for Ethereum, such as scalability, costs, and energy consumption.

The price of ETH was trading at $1,450 on Monday with the recent low being around the $886 level.

XRP

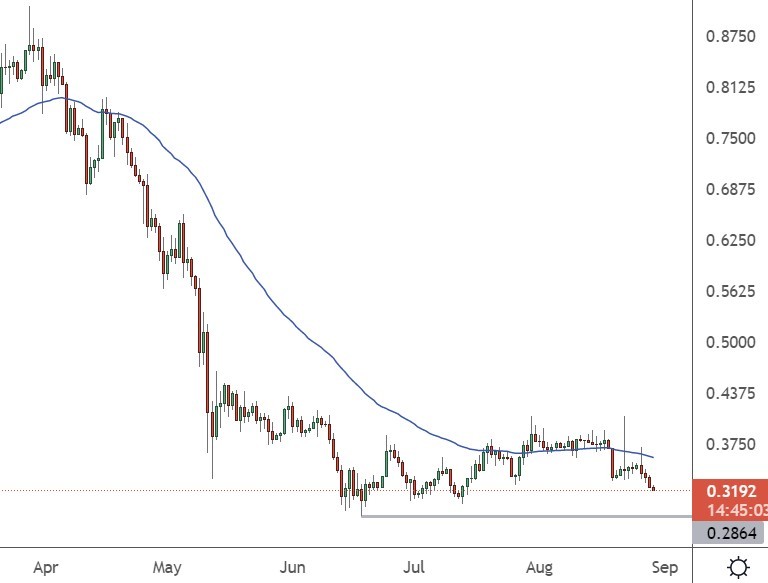

The Ripple XRP price saw a rise and fall last week with a 6% jump that faded away.

The move to $0.37 was a two-week high and occurred hours after its network processed three massive transfers worth $51 million involving crypto exchanges Bitso and FTX, as highlighted by Whale Alert.

There has still been no resolution to the ongoing SEC legal case that claims XRP is a security and that continues to weigh on the token. Meanwhile, the project announced its flagship event, “Ripple Swell Global,” to be held in London in November 2022.

Recently, Ripple CEO Brad Garlinghouse also said that the project is willing to explore a different path if they lose the SEC lawsuit. He also said that the company is willing to explore moving to a different jurisdiction in the event of an unfavorable court ruling against the SEC.

XRP was trading at the $0.32 level but the coin is looking bearish and may be lining up a retest of the $0.2865 lows from June. That will happen this week if stocks and crypto remain under pressure.