XRP

Ripple XRP continues to be weighed down by the SEC court case which alleges the coin is a security.

Ripple has requested permission from the court to serve two subpoenas in order to obtain video recordings for authentication. The defendant’s request involves a July 19 order that directed both parties to meet and discuss Requests for Admission (RFAs) asking to authenticate the seven specified videos in which SEC officials made public remarks.

“Such agreement might entail creating downloaded versions on the remarks for the purposes of authentication and preservation”, the Judge said.

The SEC is making things hard for Ripple after the plaintiff told Ripple it will only authenticate the remarks once Ripple provides them with downloadable copies of the videos, despite those being available on the likes of Youtube.

“The recordings are hosted on two video platforms and are subject to those platforms’ terms of service, which based on the Defendants’ due diligence prohibit end users from downloading their own copies without prior consent. Defendants have thus sought consent from both platforms”, the letter stated.

“The SEC’s attempt to bootstrap such conditions onto compliance with the order is wholly improper. The SEC did not serve any authenticity to RFAs during discovery, and Defendants strongly object to any attempt by the SEC to reopen discovery”, the letter added.

Attorney Jeremy Hogan has supported the XRP case with updates on Twitter and he said of the recent actions:

Ripple simply wants to authenticate 7 videos of SEC employees giving speeches and the SEC is messing around AGAIN with it. Authentication is standard stuff in litigation and should not be this difficult. Also, on a personal note, I hope that Ripple gets these videos authenticated because 3 of them are of former Commissioner Robert Jackson! And Judge Torres NEEDS to see his videos just for entertainment value.

The outcome of the case is still unsure, but the SEC is not helping Ripple’s cause by throwing obstacles in their way.

The price of XRP now trades at $0.3735 and we can see clear support from the $0.5000 level that will be the first barrier. A move above $0.8000 would propel the coin to further gains.

SEC

On the subject of SEC regulation, The Securities and Exchange Commission is said to be investigating every U.S. crypto exchange, according to staff at the Senate.

One member of Senator Cynthia Lummis’s (R-WY) office claimed that the regulator is investigating every one of the 40+ crypto exchanges in the United States, according to Forbes. The latest activity is part of an ongoing crackdown in the industry with Binance coming under scrutiny in the last months. Again, this centers around the claim that crypto tokens are securities, and the exchange tokens are under the microscope.

The U.S Commodity Futures Trading Commission has pushed back on the SEC’s pressure on the crypto industry, alleging that the SEC is engaging in “regulation through enforcement,” thus creating tension between the two financial regulatory agencies. While the SEC wants to resolve the tension, Lummis’s staffer said that legislators would get involved if it is not resolved expediently. They also expect Congress to side with the CFTC on the matter.

DCR

Decred has been gaining attention recently as squeezed crypto miners seek out a new home for their activities.

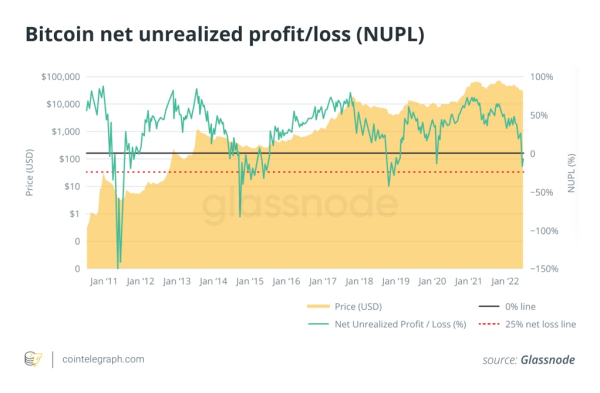

The 2022 bear market and soaring energy prices have further squeezed miners’ profit margins and could force many active miners out of business. Recent on-chain data from Bitcoin has seen a drop in unrealized profit/loss for miners below the zero line. Furthermore, some BTC dumping from large miners in May didn’t help the outlook.

Despite the gloomy outlook, the market is reacting positively to a new public chain DCRN (Decred-Next) which has been hard forked from DCR. Decred-Next was hard forked from Decred after a disagreement in the old community’s consensus about the subsidy split. Decred-Next retains the hybrid consensus mechanism of 60% POW, 30% POS and 10% treasury that was adopted by the original Decred consensus, thus the output of POW is six times that of DCR.

Despite the gloomy outlook, the market is reacting positively to a new public chain DCRN (Decred-Next) which has been hard forked from DCR. Decred-Next was hard forked from Decred after a disagreement in the old community’s consensus about the subsidy split. Decred-Next retains the hybrid consensus mechanism of 60% POW, 30% POS and 10% treasury that was adopted by the original Decred consensus, thus the output of POW is six times that of DCR.

Since DCRN’s listing on gate.io on July 18, the token price has been rising to the $20 level. Furthermore, the total hashing power has seen huge growth of 620% within only one week, jumping from 15P to the current 97P+.

That has caught the attention of investors and supporters of the original DCR community and has boosted the DCR price. The move will be helped by the recent activity in Ethereum Classic, which has seen Ethereum PoW miners migrate to the hard forked chain ahead of the ETH Merge upgrade which will make their mining rigs obsolete.

The price of DCR has also rallied with the coin doubling from under $30 to over $60 and then retracing.

FLOW

The price of FLOW was higher this week after the tech giant Meta announced that it would expand its digital collectibles offering on Instagram to 100 new countries and support the FLOW blockchains, alongside Ethereum, and Polygon.

Meta’s expansion of its digital asset plans will bring non-fungible tokens (NFT) into the mainstream, with its two billion active users worldwide. Meta announced the latest plans in a blog post and users can link their digital wallet to Instagram in order to get involved.

“As of today, we support connections with third-party wallets including Rainbow, MetaMask, Trust Wallet, Coinbase Wallet, and Dapper Wallet coming soon,” Meta said.

Meta is also adopting the Flow blockchain, which was developed by CryptoPunks creator Dapper Labs, and assets minted on the Flow blockchain will be available on Instagram. Meta set the ball rolling on its metaverse rebrand in November 2021. Since then, the company has poured $10 billion into its Metaverse arm, Reality Labs, and hired 1,000 staff, but much of its plans are still secret.

The company’s CEO, Mark Zuckerberg, said previously:

We’re not just building technology. We’re trying to also help foster this ecosystem, because at the end of the day, we’re not going to build most of the content – by a long shot. The vast majority of it is going to get created by creators in the ecosystem. And so I think a big part of what we need to do is really lean into all of the different ways that creators could make money.

The price of FLOW has rallied to prices above $3.50 but has settled at the $2.61 level.

SOL

There was no mention of the Solana blockchain in the Meta plans and that adds to a bad week where the project suffered a hack.

On Wednesday, thousands of Solana wallets were drained of their funds a day after a “crypto-bridge” called Nomad lost around $200m in a hacker attack.

The Solana team said: “Engineers from multiple ecosystems, with the help of several security firms, are investigating drained wallets on Solana. There is no evidence hardware wallets are impacted.”

Phantom and Slope digital wallets have been drained of around $5m and the investigation is attempting to understand how those non-custodial wallets could be drained of their funds. Some cryptocurrency analysts are speculating that this hack could signal a deeper issue with the Solana blockchain. Non-custodial wallets are meant to ensure maximum protection as only the owner has access to the private keys. Over $1.8bn in crypto has already been stolen via cross-chain hacks this year alone.

The price of SOL trades at $40 and we can see a key uptrend line protecting the project from further losses. The price will need to rally and secure this as the lows in the top ten coin.