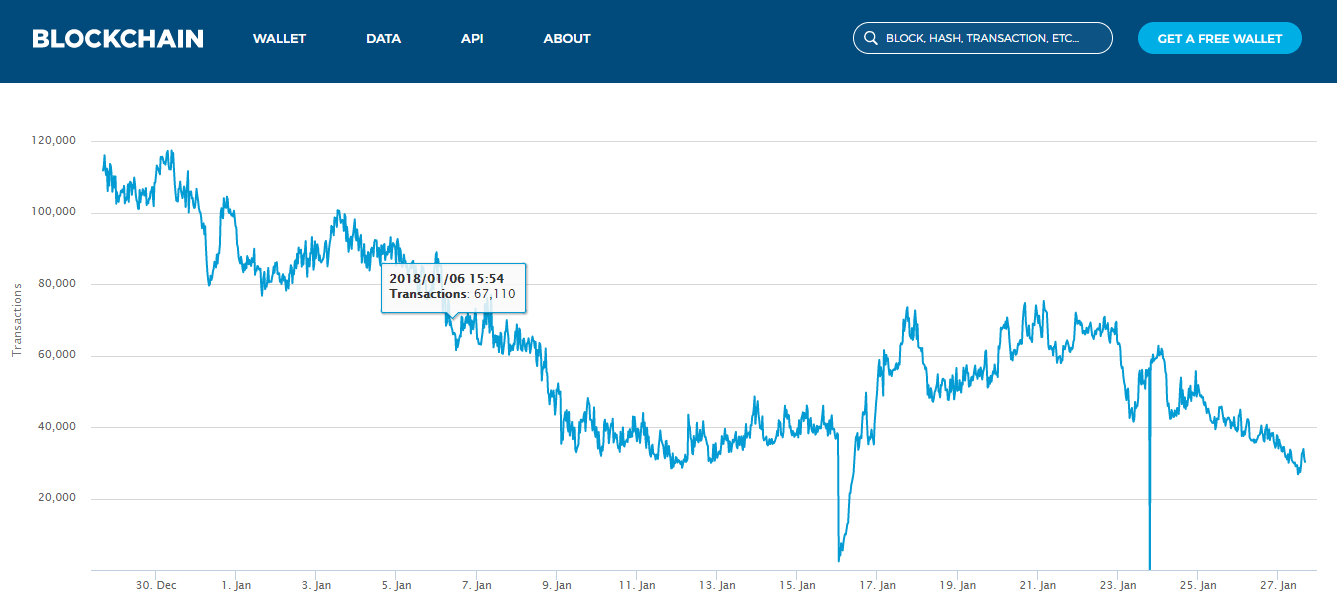

With thousands of bitcoin transactions per day, bitcoin can no longer be unjustly dismissed as a speculative fringe fad which only attracts geeks and gamblers. Considering all the attention this cryptocurrency has been getting from mainstream media and serious investors, it is disconcerting that the majority of these reports don’t contain even the most basic bitcoin transaction chart. Due to the nature of cryptocurrencies, bitcoin transactions live a life of their own, safe from third party interferences. Still, in order to understand the differences in how bitcoin transactions work, we must first get familiar with the whole notion of transactions in general.

The road to bitcoin transactions

The most basic and oldest transactions are now known as a non-monetary exchange, a barter system and an exchange of goods or objects. The second step was the development of commodity money, i.e. commodities that have intrinsic value but are also used as money because their value is more or less constant and agreed upon. Coinage developed as one form of representative money. Coins made of precious metals also had intrinsic value beyond the assigned value. Banknotes or paper money first developed as receipts or confirmations that a money lender or a merchant (and later bankers) has received a deposit of a certain amount of coins.

Modern money is issued and controlled by national governments. The value of paper money or fiat currencies is based on our faith in the value of the currency and the government’s ability to guarantee for and enforce that value. In today’s world, however, the majority of the money is digital, existing only on electronic bank accounts and even more removed from any tangible value. Economists estimate that only 8 % of all the money in the world actually exists as hard, cold cash. The money is not actually there; it’s just a number confirming it on a screen. There are many inherent dangers of this system, as normalized as it has become. First of all, it places a lot of power in the hands of banks and other financial institutions. Even if we disregard that, what if the bank goes under, what if the data gets compromised?

Bitcoin transactions are the next step in this evolution, the newest development relying on cryptology to prevent any potential tampering, thus increasing both trust and fungibility. And while some may argue that the technology of cryptocurrencies makes bitcoin illegal transactions possible, the security and freedom it offers have not been achieved or rivaled by other currencies up to this moment.

Sending and receiving bitcoin transaction

The way how bitcoin transactions work is crucial in differentiating bitcoin from regular digital money. The most important difference when it comes to bitcoin transactions is that there is no middleman. The network itself oversees and confirms everything. The sender broadcasts signed data to the network. and if the data checks out, it is added to a block in the blockchain. Imagine it as confirmed transactions being collected, confirmed and placed inside a binder (block). The binder is then put on an organized shelf (blockchain) in a way that makes it impossible to change any one entry without changing all other entries. Cryptography ensures the integrity and the order of the entries. But with so many bitcoin transactions per second, who does the organizing? Well, it is a shared communal effort, with members of the community dedicating their time and hardware resources to solve complex equations to sort it all out. They are rewarded for their essentially administrative / cleanup work with small amounts of bitcoin. This process is called bitcoin mining: participants are compensated for their effort by releasing new bitcoins.

Want more details? If you think you can handle it, here’s the nitty-gritty:

- Both the sender and the receiver need a bitcoin wallet. Installing a bitcoin wallet client on your computer generates a bitcoin address.

- Bitcoin is sent to an address. A new address is needed for each transaction. An address is not the same as a wallet, but it is linked to a wallet.

- The bitcoin received always remains classified within the wallet as separate entries based on specific originating transactions. The received amounts of bitcoin, distinct as they are, are called outputs of their transactions.

- The outputs can be unlocked using a private key. This key is fixed, unlike the address. The key serves as a signature, providing mathematical proof that the transaction found its way to the owner of the wallet.

- When sending bitcoin, the sender chooses one of the outputs he has received to become an input. The entire amount is used in the process, with the part being sent becoming an output transferred to a new address, while the rest remains as “change”, becoming new output in the sender’s wallet.

Bitcoin Wallets

The limitations of bitcoin transactions

The biggest potential hurdle of bitcoin transactions is the problem of waiting for confirmation. It takes up to 10 minutes for a new block to be created, confirming the transaction as valid. However, something we can refer to as a bitcoin transaction accelerator actually does exist. It relies on the fact that merchants can allow zero-confirmation transactions, even though the security of such transactions can be brought into question. The most recent innovations make instantaneous transactions infinitely more secure. For example, the Inter-Channel Payments system by Bitpay is an actual bona-fide bitcoin transaction accelerator, with others in the works.

Another issue lies in the so-called bitcoin scalability problem, which limits the number of bitcoin transactions per second. The problem arises due to the fact that the size of blocks in the blockchain is limited to one megabyte. With a block confirmed approximately every 10 minutes, the number of bitcoin transactions per second is currently limited to 3,3 to 7 seconds. The good news is that this only appears to be a temporary bottleneck issue and efforts are underway to further increase the number of bitcoin transactions. For the time being, the bitcoin transactions per day are a much more significant statistic than the bitcoin transactions per second. Bitcoin is not yet as prevalent when it comes to small transactions and buying goods and services online to actually necessitate a higher volume of bitcoin transactions per second.

Bitcoin Unconfirmed Transactions

Legal considerations of bitcoin transactions

You may be wondering is bitcoin legal and can it be used without any fear of authorities. Just looking at a typical bitcoin transaction chart, it is obvious that the information exchanged between the sender and the receiver is very scarce: basically, just the bitcoin address and the amount exchanged. This issue of anonymity raises concerns about potential bitcoin illegal transactions, such as money laundering. When addressing these concerns, however, it is necessary to point out that the legality of a transaction is tied to the two parties participating, not the medium of the exchange. Today, there are third party programs and payment processors which make bitcoin much more user friendly, enabling features such as receipts and web confirmations which make the users much less likely to be accused of bitcoin illegal transactions. Moreover, the receipts should be enough to please even the IRS.

Therefore, you have nothing to worry about when engaging in bitcoin transactions. If you want to buy and sell this cryptocurrency, you are at the right place to get started. Check out our reviews of various exchanges, read our other articles detailing the world of cryptocurrencies, and you will be fully prepared to become a full-fledge trader. Good luck!

The post How do bitcoin transactions work appeared first on Crypto Trading Reviews.