The RBA has wrapped up its CBDC pilot program and outlined four key areas that could be improved by the introduction of central bank-issued digital currency.

Australia’s central bank has completed it’s pilot of a central bank digital currency (CBDC) exploring use cases for a potential e-AUD, finding its useful in four main areas including enabling complex payments and asset tokenization.

The Reserve Bank of Australia (RBA) and the Digital Finance Cooperative Research Centre (DFCRC) unveiled their findings in a 44-page Aug. 23 report that also detailed a number of cases where a CBDC wasn’t exclusively required to achieve the stated use case.

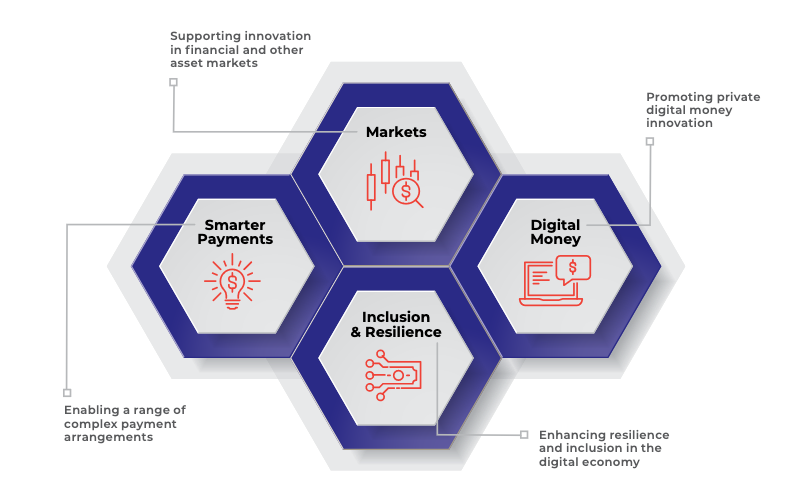

The pilot program revealed four primary areas which could be improved by a CBDC including the enablement of “smarter” payments where a tokenized CBDC enabled a range of complex payment arrangements that were not currently supported by existing payment systems.

We’ve released a report with the Digital Finance CRC @DigiFinanceCRC today on the findings from an Australian central bank digital currency pilot.https://t.co/bTT84yBp02#RBA #CBDC #Payments #DigitalPayments #Blockchain #FinTech pic.twitter.com/WXfe7lchHj

— Reserve Bank of Australia (@RBAInfo) August 23, 2023

Additionally, the report detailed that a CBDC may support financial innovation in areas such as debt securities markets, could promote innovation in emerging private digital money sectors and enhance resilience and inclusion within the wider digital economy.

A wide range of submissions from the 16 firms that participated in the pilot program highlighted the potential benefits of a CBDC in allowing for “atomic settlements” — a transaction settlement that’s both simultaneous and instant.

Programmability was also mentioned as an improvement a CBDC could offer as it could “improve efficiency and reduce risk in a range of complex business processes.”

Related: CBDCs aren’t about solving today’s problems — Australia’s CBDC lead

The CBDC pilot program was structured as a real legal claim on the RBA rather than a proof-of-concept which caused uncertainty over its legal status and regulatory treatment with participants.

“Some participants were uncertain if they were providing custody services or dealing in a regulated financial product because of holding or dealing in the pilot CBDC,” the report said. “These issues would ideally be anticipated and resolved in any legal and regulatory reforms that accompany the issuance of a CBDC.”

While the report drew attention to where a CBDC may be useful, it conceded many benefits could be achieved in other ways including using privately-issued tokenized bank deposits or asset-backed stablecoins.

“It was not clear that CBDC was exclusively required to achieve the desired economic outcomes.”

Overall, the report said while the introduction of a CBDC could increase efficiency and resilience in some areas of the Australian payments ecosystem, more research is required to fully flesh out the potential benefits.

Magazine: Tokenizing music royalties as NFTs could help the next Taylor Swift